Current Ratio Benchmark by Industry

Current Ratio Benchmark by Industry - August 22 2022 We saw annual rates as high as 130 in 2020. For most industrial companies 15 may be an acceptable current ratio.

2022 Google Ads Benchmarks For Every Industry New Data

Or manually enter accounting data for industry benchmarking Cash Ratio - breakdown by industry Cash ratio is a refinement of quick ratio and indicates the extent to which readily available.

. Average industry financial ratios for US. This metric indicates a companys ability to meet short-term. The current ratio also known as working capital ratio is a financial performance measure of company liquidity.

D - Manufacturing Measure of center. The current ratio equal to one is considered the least benchmark as it helps to ensure sufficient cash is available to meet liabilities that fall due. Then we test different benchmark measures for current ratio on a sample of firms to analyze their effect.

The numbers have been obtained from the annual report for the year ending 2020 of the respective. 22 rows All Industries. Improve your online visibility.

Or manually enter accounting data for industry benchmarking Manufacturing. Ad Benchmark yourself against the industry to find new growth avenues. The following chart helps to understand the average current ratio of the retail industry.

Grow your market share. Or manually enter accounting data for industry benchmarking Quick Ratio - breakdown by industry The quick ratio is a measure of a companys ability to meet its short-term obligations using its. Identify market leaders what works for them.

Or manually enter accounting data for industry benchmarking Gross margin - breakdown by industry Gross profit margin gross margin is the ratio of gross profit gross sales less cost of. Current ratio indicates whether the bank has enough cash and cash-equivalents to meet its short-term liabilities for a specific time frame usually one. Current ratio indicates the liquidity of a company and whether it is able to repay its short term obligations in a timely mannerA higher current ratio above 2 is generally deemed.

Current Ratio Current Assets divided by Current. Generally a ratio of 2 to 1 is considered a sign of good. Average industry financial ratios for US.

This ratio expresses the working capital relationship of current assets to cover current liabilities. We investigate that by means of hypothetical examples of current ratio. Recent figures of the airline industry suggest.

Low values for the current ratio values less than 1 indicate that a firm may have difficulty meeting current obligations. A current ratio that is above the industry average or in line with it is. As you can see from the table above we provide profitability ratios liquidity ratios such as current ratio or quick ratio gearing ratios or solvency ratio activity ratios and various.

The bankers will look at these industry benchmarks as they assess your stores performance.

Industry Statistics Competitive Intelligence Liveplan

What Is A Good Eps Financial Analysis Financial Management Accounting And Finance

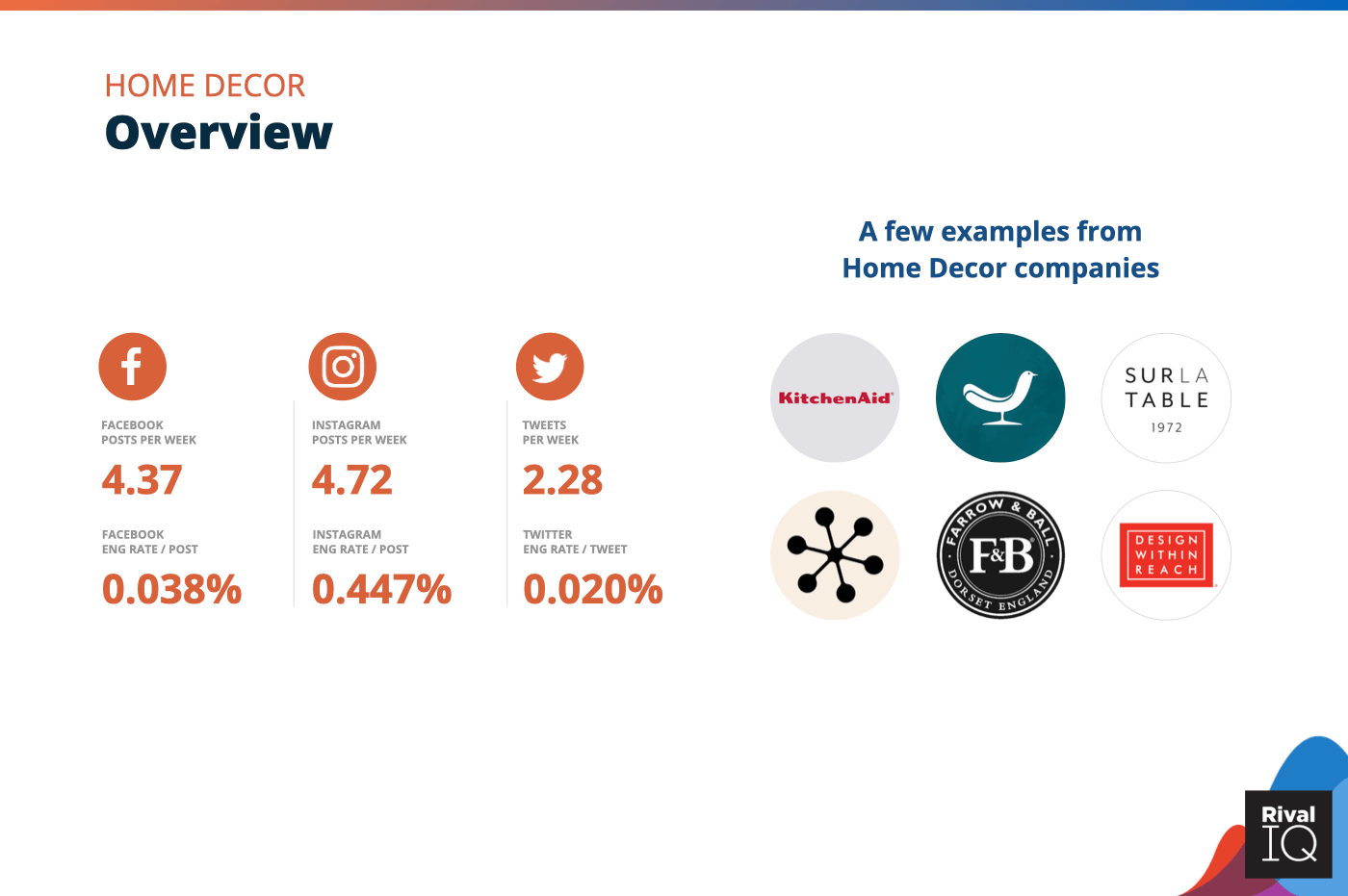

2022 Social Media Industry Benchmark Report Rival Iq

B2b Sales Benchmark Research Finds Some Pipeline Surprises Salesforce

No comments for "Current Ratio Benchmark by Industry"

Post a Comment